Lions Gate Leisure Corp. (NYSE:LGF.A), shouldn’t be the biggest firm on the market, however it noticed a double-digit share value rise of over 10% up to now couple of months on the NYSE. With many analysts protecting the inventory, we could anticipate any price-sensitive bulletins have already been factored into the inventory’s share value. However what if there may be nonetheless a possibility to purchase? Let’s check out Lions Gate Leisure’s outlook and worth primarily based on the latest monetary information to see if the chance nonetheless exists.

See our newest evaluation for Lions Gate Leisure

What’s The Alternative In Lions Gate Leisure?

Excellent news, traders! Lions Gate Leisure continues to be a cut price proper now. Based on my valuation, the intrinsic worth for the inventory is $7.99, however it’s at the moment buying and selling at US$6.39 on the share market, which means that there’s nonetheless a possibility to purchase now. What’s extra attention-grabbing is that, Lions Gate Leisure’s share value is sort of unstable, which provides us extra possibilities to purchase because the share value might sink decrease (or rise larger) sooner or later. That is primarily based on its excessive beta, which is an effective indicator for a way a lot the inventory strikes relative to the remainder of the market.

What does the way forward for Lions Gate Leisure appear to be?

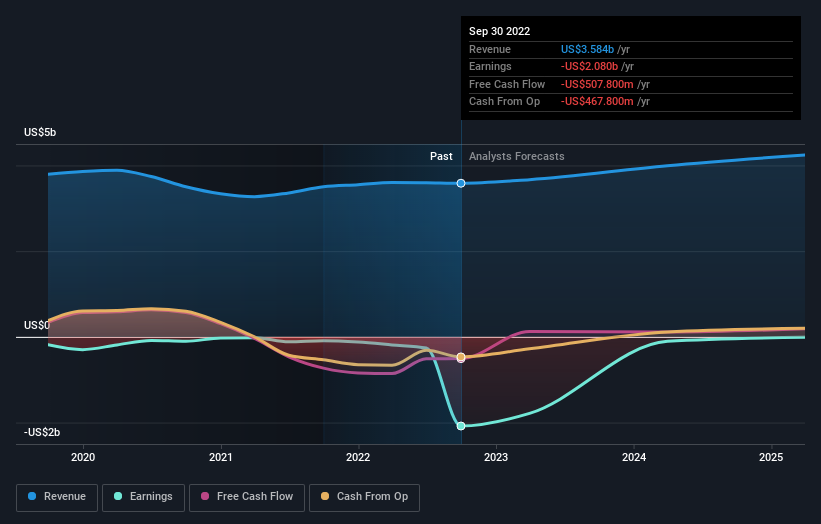

Traders in search of development of their portfolio could need to take into account the prospects of an organization earlier than shopping for its shares. Shopping for an awesome firm with a strong outlook at an affordable value is at all times a great funding, so let’s additionally check out the corporate’s future expectations. Lions Gate Leisure’s earnings over the following few years are anticipated to extend by 97%, indicating a extremely optimistic future forward. This could result in extra sturdy money flows, feeding into a better share worth.

What This Means For You

Are you a shareholder? Since LGF.A is at the moment undervalued, it might be a good time to accumulate extra of your holdings within the inventory. With a constructive outlook on the horizon, it looks as if this development has not but been totally factored into the share value. Nevertheless, there are additionally different components resembling monetary well being to think about, which might clarify the present undervaluation.

Are you a possible investor? If you happen to’ve been keeping track of LGF.A for some time, now is likely to be the time to make a leap. Its buoyant future outlook isn’t totally mirrored within the present share value but, which suggests it’s not too late to purchase LGF.A. However earlier than you make any funding choices, take into account different components resembling the observe file of its administration group, to be able to make a well-informed funding resolution.

In gentle of this, if you would like to do extra evaluation on the corporate, it is important to learn of the dangers concerned. Whereas conducting our evaluation, we discovered that Lions Gate Leisure has 2 warning indicators and it will be unwise to disregard these.

If you’re now not occupied with Lions Gate Leisure, you should use our free platform to see our record of over 50 different shares with a excessive development potential.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Lions Gate Leisure is doubtlessly over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved concerning the content material? Get in contact with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We intention to carry you long-term targeted evaluation pushed by basic information. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.